Throughout the year, we reach out to the media for announcements and insight, but one Beyond Finance study earned recognition on a “Best Of 2023” list. In June 2023, the Beyond Finance study touched upon “What Would You Do to Be Debt-Free?” The numbers gathered from this research was interesting.

With only 38% of respondents believing they are “very confident” in their ability to remain out of debt, the other 62% shared diverse reasons why getting back in debt would happen inevitably.

- 54% cited the cost of living

- 46% unexpected expenses

- 29% stressed rising interest rates

- 16% would still worry about “keeping up with the Joneses”

That Beyond Finance study helped many people nationwide. It caused a few laughs in the process. And StudyFinds.org just named it as one of its “Best Money Studies of 2023.” We couldn’t be prouder of the work that went into this research and the end result.

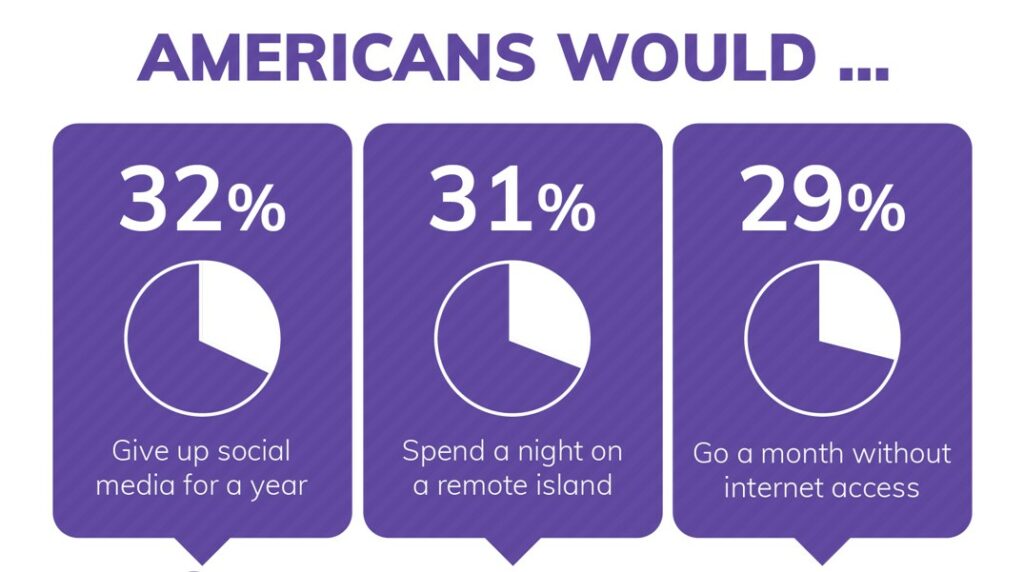

Despite the troubles of personal debt, Americans would be willing to pay an interesting price to get out of debt.

- 32% of polled respondents would give up social media for a year

- 31% would spend a night on a remote, deserted island

- 29% would endure a month without Internet access

- 18% would plan on going storm chasing

- 12% would swim with sharks

- 11% would go to Pamplona and run with the bulls if it meant no more debt, bills, or calls

Dr. Erika Rasure, Chair of the Financial Therapy Clinical Institute Research Board and one of Beyond Finance’s client financial therapists, said that the stress of debt could cause people to put their lives on hold.

“Debt can sometimes deter people’s short- and long-term goals,” said Dr. Rasure. “Learning to manage it effectively can be life-changing, but almost half of those surveyed admit feeling anxious about their debt, which may make it challenging to focus on finding solutions.”

For more information about the research, Dr. Rasure’s work with Beyond Finance, or work to move people beyond debt, visit our newsroom today.