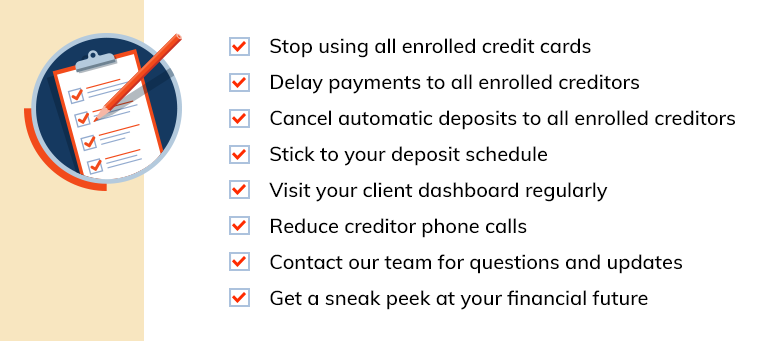

8 Things To Do at the Start of Your Debt Resolution Program

Many of our clients experience a great sense of relief when first enrolling in their Beyond Finance program. With reassurance from our Client Success Team and a timeline set in place, you can step back and let us do the heavy lifting.

Of course, we understand that “new program feeling” can fade while waiting for your first resolution offer. Even though your enrolled debts are in the hands of experts, it can feel pretty scary to let someone else lead the way.

What can you do while you wait for us to secure your new resolution offers? Here are our top eight recommendations:

Stop Using All Enrolled Credit Cards

We get it — old habits are hard to break. It can be especially difficult if your enrolled debts include credit cards with rewards programs. Is it worth it to pay another way when you can earn discounts, cash back and airline miles?

Consider the following whenever you’re tempted to pull out your card:

- No reward program is worth going into debt over. In the grand scheme of things, saving five cents per gallon at the pump won’t make your current debt go away. These offers work as a temptation for card holders to spend more than they can afford to pay back.

- Debt + Debt = More Debt. You enrolled in your program to overcome your debt. If you make your current deficit larger, it will take longer to pay everything off and graduate from your program.

Delay Payments to All Enrolled Creditors

A crucial step in the debt resolution process is to pause payments on all of your enrolled debts, and instead direct those funds towards a Dedicated Account that will be used to pay new resolution agreements later on. In reality, this can be easier said than done, and a big reason is because of the many emotions tied to money and debt.

Here’s a relatable example: most of us have grown up being taught to return things when someone lets us borrow them. After all, it’s the friendly and neighborly thing to do! But if we don’t return those things, our friends and neighbors may consider us to be irresponsible or untrustworthy.

These basic feelings are often tied to money, too — you asked to borrow it, it’s your duty to return it, and you’re a bad person if you don’t. However, there’s a big difference between borrowing money from a lender when you’re in a bind and borrowing your neighbor’s lawn mower: significant fees and interest.

If you find yourself feeling uneasy about delaying your payments, remember that your creditors will still get paid — on your terms. Our team will work on your behalf to reach an agreement that’s fairer, saves you money, and puts your debts behind you faster.

Cancel Automatic Deposits to All Enrolled Creditors

Those “set it and forget it” payments are truly easy to forget about! If you’ve set up automatic payments with your creditors, be sure to turn them off.

It’s usually easiest to contact your creditors directly and ask them to cancel these payments. If a creditor tries to give you the run-around, you can also contact your bank and ask them to place a stop payment order, but note that your bank may charge you a $15-35 fee for this service.

Stick to Your Deposit Schedule

On-time deposits help fuel your debt resolution program. The faster you raise funds in your Dedicated Account, the sooner we can negotiate new agreements with your creditors on your behalf.

If you’re interested in speeding up your program, go for it! Many of our clients make extra one-time deposits whenever they receive “surprise money,” like tax refunds or work bonuses.

On the flip side, we understand that emergencies and unforeseen circumstances can affect your ability to make your deposit on time. Our Client Success Team will work with you to find the right solution no matter the circumstance. Be sure to contact us at least five days before your scheduled deposit date so that we can pause any scheduled withdrawals if we need to.

Visit Your Client Dashboard Regularly

Your Beyond Finance Client Dashboard is designed with your needs in mind. You can use it to track your program process, get answers to frequently asked questions, chat directly with our Client Success Team and more.

You can log into your Client Dashboard on our homepage and the Beyond Finance app — download it on the Apple App Store or Google Play.

Reduce Creditor Phone Calls

Creditor calls may increase when you begin your debt resolution journey. We encourage our clients to avoid answering calls from unknown numbers. However, we also know that creditors and debt collectors can use tricky tactics to get you on the phone and demand payment.

Fortunately, there are a few easy actions you can take to reduce the amount of unwanted calls you may receive. These include blocking phone numbers, letting unknown numbers go to voicemail and reporting repeated creditor calls to our Client Success Team.

Contact Our Team for Questions and Updates

We’re here for you every step of the way. Please reach out to our team any time!

- Phone: (800) 282-7186

- Email: [email protected]

- Live Chat Support: Available 24/7 at www.beyondfinance.com

Get a Sneak Peek at Your Financial Future

Enrolling in your Beyond Finance program is only the first step on your debt-free journey. Get inspired and read more from our current and previous clients: