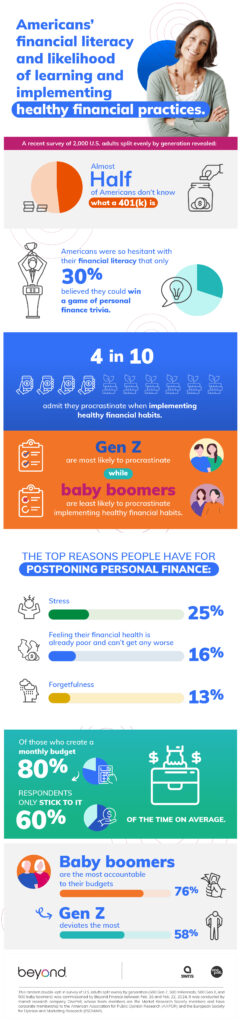

A national survey of 2,000 Americans, evenly split by generation, revealed nearly half (43%) of the respondents don’t know what a 401(k) is. The comprehensive survey examined Americans’ financial literacy, commitment to learning and adopting healthy money habits, and feelings regarding their bank accounts and financial futures.

The study, commissioned by Beyond Finance for Financial Practice Week and conducted by OnePoll, revealed that despite these startling knowledge gaps, only two in five respondents or 39%, consider themselves more financially literate than the average person.

The results indicated a significant lack of confidence among respondents regarding their financial literacy, with only 30% believing they could win a game of personal finance trivia. Over a third (35%) confess to not knowing the term “interest” in a financial context.

Four in 10 Americans admit they procrastinate when implementing healthy financial habits. Gen Z are most likely to make financial improvements, while millennials are least likely to make changes to improve their finances.

The top reasons cited for postponing personal finance tasks include stress (25%), feeling their financial health is already poor and can’t get any worse (16%) and forgetfulness (13%).

The study also reveals that Americans typically check their banking app twice daily. Yet, exactly half of respondents say they feel nervous when opening their banking portal, with Gen Z feeling most uncomfortable (65%) and baby boomers feeling the most calm (26%).

“Unfortunately, avoiding looking at your finances and making healthy changes is incredibly common,” said Erika Rasure, Ph.D., chief financial wellness advisor of Beyond Finance.

“Some people tend to neglect taking stock of their financial situation, and others can become nervously consumed by it. There’s a middle ground to take when improving your financial health—learn healthy money habits, pay attention and make small, achievable adjustments to your spending and habits.”

Regarding budgeting habits, eight in ten respondents try to hold themselves accountable to a monthly budget, with millennials and baby boomers tying for the best-laid financial plans (81%).

Of those who create a monthly budget, respondents only stick to it 66% of the time on average, with baby boomers exhibiting the highest accountability (76%) and Gen Z deviating the most from their budgets (58%).

For those trying to save money, the most popular strategies include buying on-sale items (53%), using coupons and discount codes (47%), limiting spending on clothing (45%) and shopping at discount stores (42%).

However, a considerable portion of respondents resort to more drastic measures to save money, such as infrequent social outings to bars and restaurants (39%), limited travel or not traveling at all (36%), rarely or never buying coffee at coffee shops (35%) and rarely or never buying gifts (32%). Notably, 33% of respondents said they never take vacations.

Financial habits can also influence relationships, as evidenced by nearly four in ten (39%) respondents reporting adverse effects on their relationships due to their or their partner’s unhealthy spending habits.

A majority of those in relationships (63%) agreed that learning about personal finance as a couple would increase their chances of improving money habits successfully in the future.

“The first step in a happier financial future is education,” said Dr. Rasure. “The more you know about money and personal finances, the more equipped you’ll be to make better decisions and create a plan to meet your goals. That’s why Financial Practice Week is important. We want to encourage people to learn the money habits and practices they’ve been putting off so they can make progress toward a more stable, optimistic future.”

For more information about Accredited Debt Relief and Beyond Finance or their superior work with clients to move beyond debt, visit www.accrediteddebtrelief.com or www.beyondfinance.com.