How Beyond Finance Helped Alex C. Get Back on Track

Many people fall into debt after experiencing a sudden financial blow, such as a medical emergency, job loss or an unexpected home repair. However, you can still fall into overwhelming debt even if you’re not facing trying times.

This was the case for Alex C., a young professional in Texas. After losing track of his credit card spending, he found himself in major debt and unable to get a consolidation loan. Luckily, a personalized debt resolution program helped Alex regain his financial footing and prepare for future home ownership. We sat down with Alex to learn more about his experience with Beyond Finance and his debt-free journey.

“That’s where it got out of hand.”

Alex’s financial troubles began when he started to receive credit card offers in the mail. He had a decent income thanks to his office job, but credit cards provided him with the opportunity to spend more.

“My credit score was pretty high from establishing it from a smaller credit card,” he explained. “These bigger companies were starting to jump in, and I started receiving larger and larger limits. I felt like I could start traveling and use these credit cards to experience things that I hadn’t been able to experience before. That’s where it got out of hand.”

With new lines of credit seemingly at his disposal, Alex relied on his cards to pay for international travel.

“I had a wonderful time,” he said, “but I noticed that my credit cards were starting to be maxed out. My paychecks weren’t adding up enough to pay them off, and it became unmanageable.”

In an attempt to regain control of his finances, Alex began to look for ways to consolidate his debt.

“I tried to get some kind of personal loan to move all of those funds together from a credit card to create just one monthly payment,” Alex explained, “and nobody would give it to me because I was maxed out.”

“It turned out not to be fake — it was real.”

When Alex’s consolidation plans fell through, he was at a loss for where to turn next.

“I had no idea of any other types of options,” he said. “I mean, at that point, my credit card balances were so high that all I was really able to do was make these minimum payments, so there was no principal being paid off.”

Fortunately, Beyond Finance reached out to Alex directly over the phone to offer their help.

“They told me what they were all about and how the process worked,” Alex recalled. “At first I was kind of like, ‘This is a scam, nobody can handle the credit card companies like this, how is this a real thing?’ But it turned out not to be fake — it was real.”

During Alex’s first call with Beyond Finance, a Consolidation Specialist explained how the process worked. After conducting an interview about his overall financial situation and starting his customized program, Alex would begin to redirect his monthly payments to his creditors. He would instead make monthly deposits to a Dedicated Account that he owned, and the Beyond Finance team would connect with Alex’s creditors to reach more favorable terms and agreements on his behalf.

“That made me really interested,” he noted. “That alone was like, ‘Okay, well now I don’t have six different payments to make all month — I have one.”

Alex continued to research the debt resolution company after his initial phone call.

“I looked Beyond Finance up on the BBB, and they had an A+,” he said. “That stuck out to me, that sealed the deal. I wanted to do something that would help me, and so I said to myself, ‘If you have no other options, and it seems like it’s going to be something you can afford, why not?’ I had no hang ups.”

“You have to trust the process.”

After completing his research, Alex chose to call Beyond Finance back and sign up for the program.

“My onboarding was very smooth,” Alex said. “It was very quick — it flowed very well.”

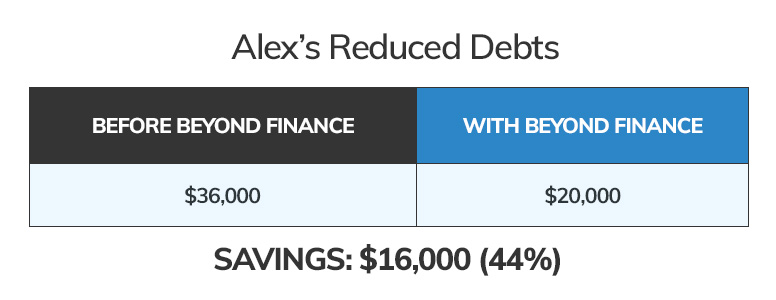

The Client Success Team helped him enroll about $36,000 of debt in his program. While Beyond Finance started working directly with his creditors, all Alex was tasked with was making monthly deposits into his Dedicated Account.

“It felt really strange. For the first few months, all I’m doing is making deposits to a company, and not paying any of my actual debt,” Alex said, explaining how he felt nervous while waiting for Beyond Finance to secure his first new agreement with his creditors. Fortunately, he was able to talk with a Client Success Specialist who provided him with support.

“They gave me a lot of reassurance, saying, ‘I know it feels weird, I know it seems quiet or eerie, but I promise you things are happening in the background,’” he explained. “Sure enough, a couple months later, there was an email saying, ‘Congratulations, we have your first Resolution Offer.’”

“When the first offer came about, it was this big sigh of relief,” Alex recalled. “You have to trust the process, and eventually I did.”

“You feel like you’re taking control of your life again.”

Alex felt more confident about his financial future as more resolution Offers came in. “It’s very reassuring and it’s very affirming — you feel like you have power,” he explained. “It’s good for your mental health, like, ‘I’m being an adult. I’m taking care of myself. I’m taking care of what I need to take care of.’ You feel like you’re taking control of your life again.”

When asked what the biggest benefit of completing his Beyond Finance program was, Alex pointed towards his savings. Beyond Finance was able to reach new resolutions with his creditors and reduce his total enrolled debt to about $20,000, allowing Alex to keep more than 40% of what he originally owed before program fees.

“There’s more money in my pocket. I don’t have loans anymore,” he noted. “It’s allowed me to not have nightmares about debt collectors. There’s less stress in my life because of this. When you have less financial issues, I feel you tend to be happier.”

“My life got better.”

Since graduating from his Beyond Finance program, Alex says his life has felt more stable.

“Once I finished the program and my credit score went back up,” he said, “there wasn’t as much stress in my life. My life got better.”

Alex now has a platinum American Express card, which he has been able to use to make large purchases and repay appropriately. He’s also thinking about purchasing a home in the next few years, and feels more prepared to handle his future mortgage payments after his Beyond Finance experience.

“Beyond Finance also helped me to be more aware of spending in general,” Alex noted. “I’m a lot more aware of my spending because of it. I had this new head about me, where it’s like, ‘Okay, I’m going to get a credit card, but it’s a second chance — I’m not going bananas.’”

“If Beyond Finance hadn’t called, who knows where I’d be right now?”

From the company’s ability to reach new resolutions with creditors to how smoothly his program ran, Alex is happy that he completed his Beyond Finance program.

“It’s a great program, I’m glad I did it,” he reflected. “If Beyond Finance hadn’t called, who knows where I’d be right now?”

For those who are struggling with debt and considering their debt options, Alex recommends researching thoroughly and having conversations with debt consolidation representatives.

“Think about it this way,” he suggested, “If you’re just going to be paying one monthly payment at a price you can afford, and it will help you get rid of your debt, why would you not? If you’re going to get a consolidated loan for four years, you might as well get into a program where it’s going to help you get rid of your debt. Hesitate all you want, but do your research, too. I hope that somebody who’s in the position I was in would really consider Beyond Finance, because it helped in a lot of ways.”

Alex was provided with a gift card in exchange for his time and for sharing his honest opinions about his Beyond Finance experience.