Feeling Like a Million Bucks: The Secret to Financial Wellness

Many people pride themselves on physical fitness–going to the gym, eating right, drinking water, and getting enough sleep. Emotional intelligence requires more work because it involves understanding social cues, using tact, watching your tone of voice, and empathizing with others.

Then, financial wellness, often a misunderstood or unknown mindset, can impact physical fitness and emotional intelligence. Unfortunately, most Americans don’t take the time to learn or apply it.

The adage says, “Money makes the world go round,” because you aren’t going far without it. Transportation, rent, entertainment, food, education–it all costs money, and your finances won’t last long without the skills to manage it. Yet, it’s vital to know you’re not alone if you aren’t sure how.

Personal Finance Creates Private Health Concerns

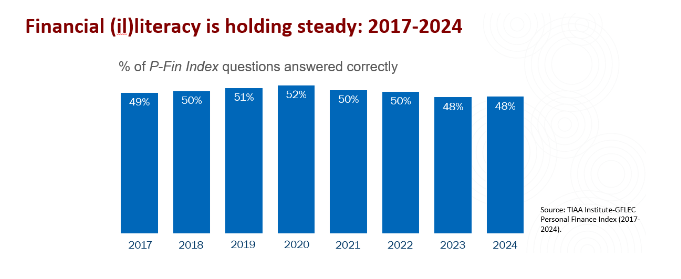

The World Economic Forum and TIAA have a metric known as the “P-Fin Index” (for “personal finance”). Based on insight from economists, financial planners, and banking executives, the P-Fin Index delves into eight functional areas across 28 questions related to risk and reward, savings and spending, cost of living and earning income.

Since 2017, the index has remained around 50%, but over the past two years, there has been a 2% drop, showing that only 48% of U.S. adults believe they have proper financial literacy. With inflation, supply chain issues, and a tumultuous job market, Americans aren’t at peace with their bank account.

That peace could also be connected to financial knowledge. If you understand your budget and personal finances better, you can manage your dollars and cents more effectively.

Earlier this year, Beyond Finance explored Americans’ financial knowledge or understanding of managing money. Some numbers we discovered were startling about Americans’ confidence in their finances.

- Nearly half (43%) of respondents don’t know what a 401(k) is

- Only 30% believe they could win a game of personal finance trivia, despite 39% considering themselves more financially literate than the average person

- Four in 10 Americans admit they procrastinate when implementing healthy financial habits

- And 39% of U.S. adults report adverse effects on their relationships due to their or their partner’s unhealthy spending habits

Debt is Something You Have; It’s Not What You Are

Our notable client financial therapists, Dr. Erika Rasure and Nathan Astle, CFT-I, believe that sentiment and share it with those nationwide who entrust Beyond Finance to get past their economic struggles. Personal debt is not your identity. It’s not even part of it.

Debt results from a significant problem, bad choices, or a sudden accident. Escaping from financial struggles is a journey–often a long and difficult one. Despite the detours that seem to be waiting after each turn, there is an end to the strenuous phone calls and fear of bill collectors.

Another thing our financial therapists share with our clients to separate their identity from the issue is that their net worth is not their self-worth.

We understand that shame can overwhelm someone in debt as if they should have known better or it’s their fault for facing these problems. That couldn’t be farther from the truth. It’s that kind of misguided thinking that hampers your mental health. Focus and intent must be protected to crawl out from under the pile of debt suffocating you.

Financial wellness can be reached with a few simple changes in your life.

- Create a budget practically

- Don’t shop impulsively

- Save money automatically

- Pay bills realistically

- Get out of debt constructively

One last thing we say around Beyond Finance is, “Debt is an inside job.” Refusing money’s negative power over your life and focusing on regaining a positive relationship with your finances begins within. Look inside yourself. Getting out of debt is possible–with family, friends, or even professionals.

You’re never alone, and you can do it. That’s the secret to financial wellness. And you’re worthy to make it happen.