Budgeting 101: A Guide to Getting Started

Budgeting is often misunderstood. You may view it as restrictive and complicated, or you may have tried budgeting in the past and struggled to stick with it. Maybe you’re actively tracking your finances and looking for ways to make the process more efficient. Whatever your previous experiences are, creating and managing a budget is one of the best things you can do to improve your personal finances.

Why You Need to Start Budgeting

Ultimately, budgeting boils down to knowing where your money is coming and going. Tracking and recording all of your incomes and expenses allows you to have a better picture of where you stand financially and where you might be overspending. Budgeting can also help you discover unnecessary drains on your wallet, and allow you to plan ahead for bigger savings and debt repayment goals.

Building Your Planner

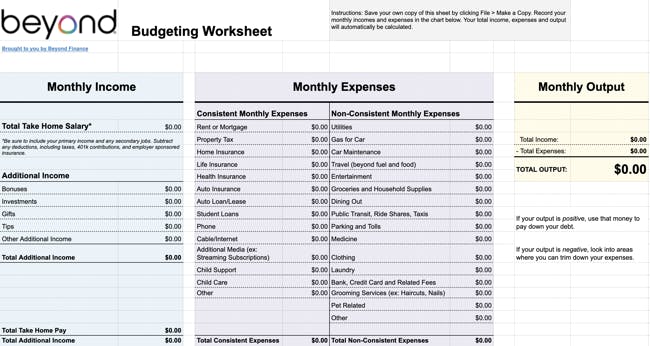

In order to create an effective budget, you need to have a clear list of your incomes and expenses. Start by collecting all of your monthly bills and pay stubs, as well as your bank and credit card statements.

While there are many different methods available for tracking your budget, we’ve found that spreadsheet programs like Excel and Google Sheets are easy to customize, save and share. We created a free budgeting worksheet in Google Sheets that can be saved and customized to fit your needs.

Now it’s time to record everything – list all of your sources of income and expenses, preferably by category. For expenses that vary month to month, such as groceries and utilities, it can help to start with an average estimate of your monthly spending, and then set a monthly spending limit later on.

Doing the Math

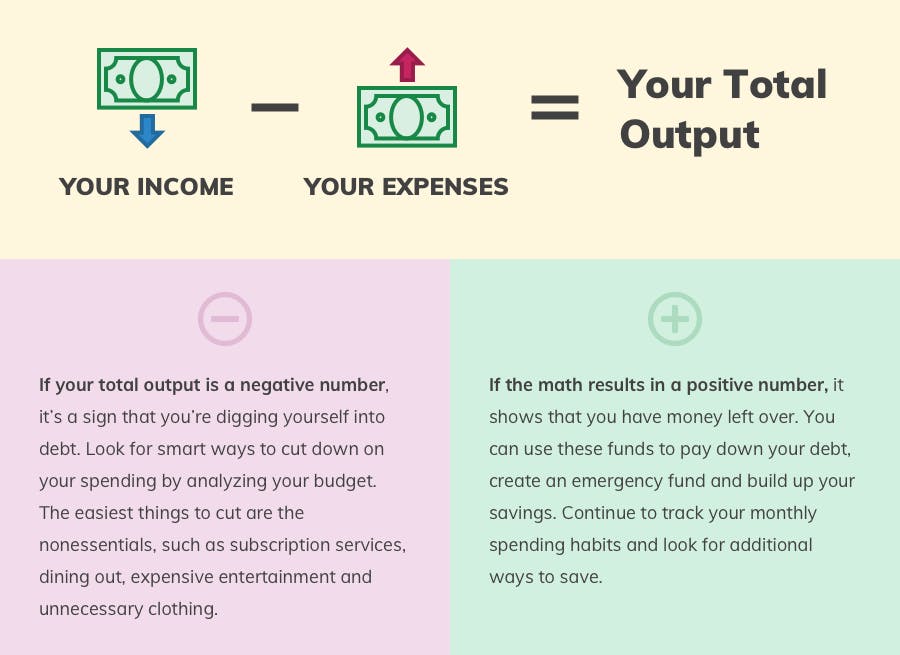

Now that you’ve recorded your cash flow, your next step is to calculate your total monthly output. Add up all of your incomes and expenses, and then plug those numbers into this formula:

Keeping the Momentum

You’ve looked at your bills, broken down the numbers and determined your total output – now what? Analyzing one month of earning and spending is only the beginning, but it provides you with the information you need to make informed financial choices.

Look for areas of weakness in your current budget that you can improve with next month’s spending and saving decisions. For example, if your money has been going towards food deliveries and dining out multiple times a week, try bumping up your grocery allotment and limiting your restaurant spending to one meal a week. If your utility bills seem high, try making changes to your home to increase your energy efficiency. Small and thoughtful decisions can lead to major savings over time.

Additional Advice

As your life changes, so will your budgeting. You should reevaluate your monthly budget whenever you’ve hit a monetary milestone, such as paying off a large debt or earning a raise. You should also update it when life’s curveballs and surprises are thrown your way, such as unemployment, an emergency home repair or an unexpected hospital bill.

It’s also important to remember that budgeting takes practice. Don’t get discouraged if you accidentally spend more than you allotted in one category or if you miscalculate along the way. Your budget is a tool that will help you gain better control of your finances over time.

Of course, budgeting won’t work at all if you don’t commit to it. If tracking everything on a spreadsheet isn’t working for you, try recording it all in a notebook or using a specialized budgeting software. Make it your mission to find the budgeting system that works best for you and turn it into a habit. With continued effort and dedication, you can build stronger financial skills through budgeting and benefit from the results.